Second Stimulus Payments Will Be Sent to Representative Payees

Do you have a representative payee? Then the IRS will send your check to them using the same method through which the payee usually receives your monthly benefits. This does not mean, however, that they are entitled to the stimulus money. The payment belongs to you.

Some people might worry that their payees may use the second stimulus check for the benefit of someone else. In that case, they will be subject to a $5,000 civil penalty on top of any other penalties possible under the law. They will also have to pay back up to twice the amount of money they used.

But watch out, you will have to send your allegation to the Social Security Administration since they do not have the authority to investigate and determine if a payment has been misused. Only after they receive the allegation can they start investigating. Afterward, they can even decide if the representative payee is no longer suitable and can furthermore appoint a new one.

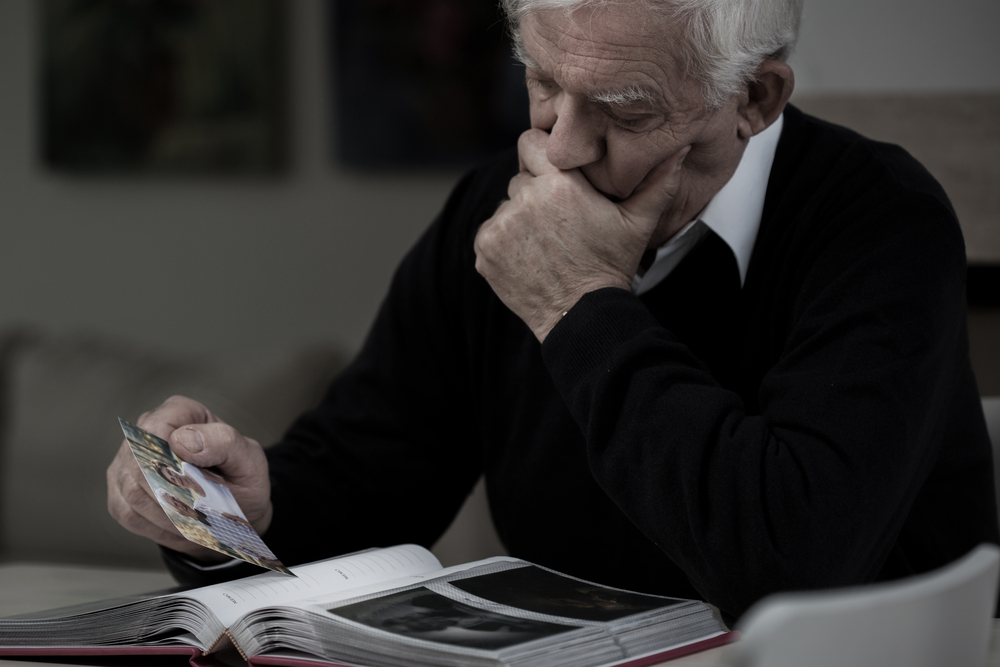

You Could Receive a Second Stimulus Check for a Deceased Spouse

There is still some confusion about stimulus checks for those who died in 2020. If a person passed away before 2020, then they and their spouses will most definitely not receive any extra money.

If your loved one passed in 2020 then it’s possible that you could receive their $600 too, either as a joint payment of $1,200 or as a separate payment. We recommend you hold on to the extra money for now, as it is unclear whether or not those who passed away during 2020 are eligible for second stimulus checks. The IRS might want it back.

During the first round, the IRS sent checks to over 1 million deceased people. Since they now have access to the Social Security Administration’s “death master file” they will presumably cut down this number of checks.